Westend Icon Aundh Pune Commercial Office Spaces for Lease

Aundh,Pune

Pune:

The future sentiments are positive but not bullish as stakeholders expect clarity, on policy issues, to come in the next six months.

Home buyers are still in the wait-and-watch mode, with sentiments in the real estate sector moving in the negative zone in the April to June period this year due to ambiguity over policy issues related to the real estate regulatory Act (RERA) and goods and services tax (GST), revealed a survey by Knight Frank India, FICCI and NAREDCO.

However, the future sentiments are positive but not bullish as stakeholders expect clarity, on policy issues, to come in the next six months.

"Stakeholders are of the view that the going forward the economy will reflect better results and become more transparent," said Samantak Das, chief economist and national director-research, Knight Frank India.

Das feels increasing transparency levels and special status given to affordable housing, by the government will smoothen the flow of institutional funds into the sector, that too at competitive rates.

Housing project launches have reduced to almost zero recently as companies were either busy focusing on completing ongoing projects or adhearing to new RERA and GST guidelines.

However, nearly 68% of the respondents feel launches will improve in the next six months. "It is likely that these positive sentiments are triggered by the upcoming festival season and expected clarity on policy issues," said the report.

However, 68% of the respondents feel that it will take time for buyers, marred by project delays, non-deliveries and litigations, to return to the market.

Around 59% of the respondents feel home prices will rise in the coming six months due to increase in compliance costs due to implementation of new policies.

"While the current sentiments are down, the future is certainly bright in the residential property market. The success for this sector lies in the proper implementation of government schemes by the respective states," Das said.

With regards to the office real estate, around 64% of the stakeholders believe that new office supply will remain a challenge in the next six months due to project delays and lack of quality office space in key locations.

This lack of supply is expected to put an upward pressure on rentals, according to about 86% of the respondents.

Kalash Montage Baner Pashan Link Road 3 and 4 BHK Price Location Floor Plan Review

Baner Pashan Link Road, Pune

Presidential Tower Pimple Saudagar Pune 3 BHK 4 BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

Magnus By Aswani Pimple Saudagar 3 BHK 4 BHK Price Location Floor Plan Recview

Pimple Saudagar, Pune

Sukhwani Celaeno Pimple Saudagar Pune 3BHK 4BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

Magarpatta Hadapsar, Pune

Westend Icon Aundh Pune Commercial Office Spaces for Lease

Aundh,Pune

Jhamtani SpaceBiz Baner Pune Commercial Project Office Space

Baner,Pune

Rahul Altimus Baner Pune Commercial Project

Baner,Pune

Kakkad One World Baner Balewadi Pune Commercial Project

Balewadi,Pune

KWT KOHINOOR WORLD TOWER PIMPRI PUNE COMMERCIAL OFFICE SPACE SHOP SHOWRROM

Pimpri Chinchwad PCMC,Pune

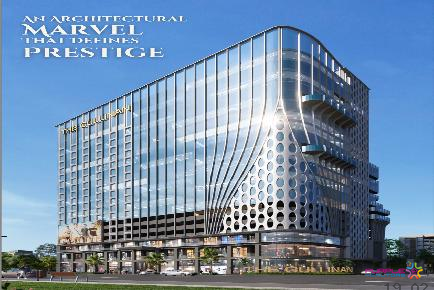

The Cullinan by Garve Pimple Nilakh Pune Commercial Project Floor Plan Review

Pimple Nilakh,Pune

SBH Solitaire Business Hub Baner Pune Office Space Showroom Restaurant Spaces For Lease and Sale on High Street Balewadi

Baner,Pune

WYNG By Kundan Spaces Camp Pune Commercial Office Space Price Location Floor Plan Review

Pune,Pune

Malpani M Kautilya in Viman Nagar Pune Upcoming Commercial Project

Viman Nagar,Pune

45 West by Kolte Patil Baner Pune Commercial Project

Baner,Pune