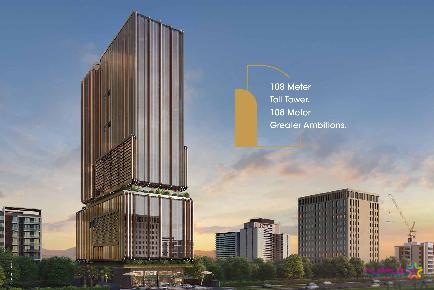

KWT KOHINOOR WORLD TOWER PIMPRI PUNE COMMERCIAL OFFICE SPACE SHOP SHOWRROM

Pimpri Chinchwad PCMC,Pune

Pune

With renewed transparency and accountability in the real estate market, investing in Pune realty could prove good value for money for NRIs. The market sentiment too is upbeat with lucrative property rates, attractive finance schemes from banks and offers and discounts from developers.

As the festive season begins, real estate developers in the Pune region have high hopes from the Non-Resident Indian (NRI) investors to bring a boom in the market and put it back on the fast track. Their aspirations and expectations rise from the fact that most NRIs visit India around this time of the year. The realtors expect that with improving infrastructure, low property prices and economic and political stability, its an ideal time for NRIs to put their money in Pune real estate.

In earlier years, the opaque nature of the realty business, with its lack of information and no due diligence, did not inspire much confidence in the Pune diaspora. However, with some of the key policy changes in the past one year, like the Real Estate Regulation Act (RERA), demonetisation, the Goods and Services Tax (GST), NRIs will now be more confident in making an investment decision. Also, to simplify the purchasing processes, several rules and regulations have been amended. In addition, lenient FEMA policies and relaxation of laws by the RBI regarding property buying by NRIs, are likely to boost their participation.

NRIs are also aware that residential inventory has piled up and they are currently very well-placed to find good bargains in these markets, as most developers are offering discounts and other attractive schemes. However, once the economy begins to grow, housing demand is again going to rise and it will lead to price escalation. So, for NRIs who are waiting on the edge, this is the right time to invest. Once the primary residence is secured, with surplus funds they can also invest in rental income-generating apartments or commercial properties as well. However, they should we wary of projects by unknown developers who have no existing track record. NRIs should strictly follow a check-list of points to verify, such as the RERA registration of developer, his track record and brand visibility, the soundness of the identified location in terms of civic and social infrastructure and amenities in the project.

Amberwood Pimple Saudagar Pune 3BHK 4BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

VTP Cielo Bavdhan Pune 2 BHK 3 BHK 4 BHK

Bavdhan, Pune

KWT KOHINOOR WORLD TOWER PIMPRI PUNE COMMERCIAL OFFICE SPACE SHOP SHOWRROM

Pimpri Chinchwad PCMC,Pune

Jhamtani SpaceBiz Baner Pune Commercial Project Office Space

Baner,Pune

Haute Capital by Bhansali Baner Pune Commercial Project

Balewadi,Pune

ONE PLACE BANER PUNE COMMERCIAL OFFICE SPACE AND SHOWROOM

Baner,Pune

Kakkad One World Baner Balewadi Pune Commercial Project

Balewadi,Pune

Malpani M Kautilya in Viman Nagar Pune Upcoming Commercial Project

Viman Nagar,Pune

AMBROSIA GALAXY BANER PUNE COMMERCIAL PROJECT OFFICE SPACE SHOP SHOWROOM SALE OR LEASE

Baner,Pune

Ceratec 108 Tower Balewadi Pune Commercial Project

Balewadi,Pune

Rachana Business Bay Baner Sus Pune Commercial Project

Baner,Pune

Teerth Exchange Baner Pune Commercial Project Office Space Showroom Lease Floor Plan Review

Baner,Pune