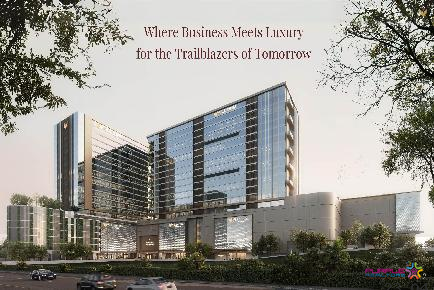

ATC Amar Tech Center Viman Nagar Pune Commercial Office Space For Lease

Viman Nagar,Pune

As Indian economy grew significantly following the opening of the market in 1991, its real estate also expanded very fast. A large base of middle-class households, growing disposable income & higher rates of urbanization in conjunction with easy credit options continued to drive residential demand in a positive manner.

Although the lockdown due to COVID has adversely impacted the housing market, there is still vast underlying demand in the market. Past data has indicated the current housing shortage to the tune of 25 million. As per Niti Aayog, Indian real estate is estimated to be around $120 billion. In 2040, it is estimated to grow five-fold to reach $650 billion.

However, the market is not going to be the same in a post-COVID world. The demand dynamics will evolve and change, as new trends will emerge. Here is a list of 5 key parameters that will change how business is done.

A Buyer’s Market: The Indian housing market is a buyer’s market as developers will float plenty of attractive schemes to offset the recent slowdown in the market and infuse demand. Major developers are coming up with plans such as 10:90, 20:80, leasing assistance & assured rental income to stimulate demand.

However, a buyer’s market might not mean that the prices will correct. Home prices have already bottomed out over the years, forcing most of the major developers to work on wafer-thin margins. Price corrections will be mostly seen in slow-moving inventories, while others will avoid any price cuts.

Importance of Home: Despite an unavoidable economic slowdown & palpable uncertainty in the market, this lockdown has also reinforced the importance of Home. Probably, it is the only place where you are safe and secured. People who are living in rented accommodation would prefer to buy homes soon. As home loans are also cheap, buyers will like to leverage that. The importance of Real Estate as a safe, sound & tangible asset to invest in will also rise.

If we look at the modern Indian cities, they are expanding at an unprecedented rate due to organic as well as inorganic means (migration).Amidst such unimaginable growth, people understand the sooner you own a home, the better.

Demand will rise in peripheral areas: In the times to come, people will try to migrate from congested city centers to peripheral areas with townships, larger open spaces, greener spaces, etc. As many individuals will continue working from home, they will opt for larger spaces with dedicated workstations, recreational space and extra bedrooms. Such spaces will mostly be possible in the peripheries where land prices are still affordable. Moreover, as larger vacant land parcels are available in peripheries, developers are also pivoting to such areas.

Transaction Space will consolidate: Indian real estate, especially the home market is highly unorganized. Larger advisories or institutional Channel Partners (ICP) hold around 10-12% of the market whereas the rest is run by individual brokers and smaller advisories. However, in a post-COVID world, the markets will consolidate with organized players expected to capture around 25-30% of the market in the next 1.5-2 years.

In a post-COVID world, technology and digital marketing will move to the core from the periphery. To grow in the new normal, one would require ample investments into developing extensive digital capabilities. Advisories which will have the bandwidth will grow, while others might suffer. This will eventually lead to more consolidation.

Evolution of transactional space: The real estate transactional market will evolve with more focus on asset-light models. Developers, realtors, advisories & other industry players will try to cut down on their CAPEX & OPEX in these times as a part of their business continuity plans. Real Estate players will try to work closely with channel partners and brokers and try to reduce their dependencies on a direct sales force. Amidst healthy underlying demand but a stressed business outlook, the role of franchise and associate-based networks will quadruple. Real estate will also see talented individuals from other industries such as BFSI, automobile, consulting etc. to enter the space. Many individuals will come to make a parallel source of income. This is a healthy sign for the industry, as it will help in enriching the talent pool.

For more Blogs Like this Check - https://purplerealtors.com/blog.php

Click here to like us on Facebook and see more updates like this.

Check Real Estate Updates Here - https://purplerealtors.com

For Residential Projects in Pune Check - https://purplerealtors.com/Residential-Projects

For Commercial Projects in Pune Check - https://purplerealtors.com/Commercial-Projects

If you want more tips about your Property Investment strategy, book a FREE consultation with one of our expert Investment Coaches to discuss your situation and investing goals.

Godrej Evergreen Square HInjewadi Pune 2 BHK 3 BHK

Hinjewadi, Pune

VTP Earth One 1 Mahalunge Pune Residential Project

Mahalunge, Pune

VTP MONARQUE HINJEWADI PUNE 2 BHK 3 BHK

Hinjewadi, Pune

The Crown at Gera Isle Royale Bavdhan Pune 3BHK 4BHK

Bavdhan, Pune

ATC Amar Tech Center Viman Nagar Pune Commercial Office Space For Lease

Viman Nagar,Pune

Sanas 27 West Balewadi Pune Commercial Project

Balewadi,Pune

Panchshil Eleven 11 West Baner Commercial Retail Office Space Showroom Spaces For Lease and Sale

Baner,Pune

ABIL Boulevard Koregaon Park KP Pune Commercial Project For Lease

Koregaon Park,Pune

Astra Heights Balewadi Pune Commercial Project For Lease

Balewadi,Pune

Phoenix Millenium Towers Wakad Pune Commercial Office Space

Wakad,Pune

Cornerstone Maruti Millennium Tower Baner Pune Commercial Project

Baner,Pune

Achalare Business Capital Baner Pune Commercial Project

Baner,Pune

OMICRON COMMERZ BANER PUNE COMMERCIAL PROJECT

Baner,Pune

Gera imperium gateway Pimpri PCMC Pune Commercial Project

Pimpri Chinchwad PCMC,Pune