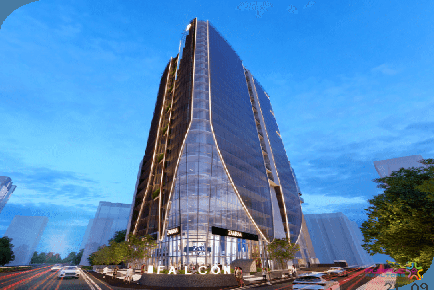

M RAMANUJAN BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

Maintenance charges were subject to the levy of service tax earlier, if the aggregate of the maintenance charges levied by the housing society exceeded Rs 10 lakhs in a financial year. Under the GST, this threshold limit has been raised to Rs 20 lakhs. So, a housing society will have to collect GST from its members, if the aggregate of the charges during a financial (whether subject to GST or not) exceeds Rs 20 lakhs. The society, therefore, will have to obtain a registration under the GST for this purpose.

However, even if the society obtains this registration, it cannot levy GST, if the maintenance charge for a flat does not exceed Rs 5,000 per month.

So, in case the aggregate of the charges levied by the housing society does not exceed Rs 20 lakhs in a year, it need not register under the GST. Therefore, it need not levy GST on the maintenance charges recovered from its members, even though the individual monthly charges for a flat may exceed Rs 5,000. In case of flats of different sizes in a housing society, it may happen that the monthly bill for smaller flats may be less than Rs 5,000 and thus, outside the levy of the GST. The other members having larger flats in the same housing society, may have to pay GST.

It is not that the society shall collect the GST on all the components recovered from the members. The housing society will not recover GST from you, on charges in the nature of reimbursement of expenses incurred by the society and recovered from members. These include various taxes paid by the housing society on behalf of the members, like municipal tax, property tax, water bill, non-agricultural land tax, etc.

Likewise, contribution towards the sinking fund, is also excluded from the scope of GST. However, the housing society will have to levy GST on the contribution towards the repairs funds, collected from its members.

The housing society will have to levy GST at 18 per cent, on the maintenance charges recovered from its members. The housing society can avail of the input credit, for the GST paid by it on various supplies received by it (for example, services like security or payment of audit fees). Although the society will be able to avail the input credit for such items, it cannot reduce the rate of GST being charged to its members. The society will also have to pay GST under the reverse charge mechanism, in case it is registered under GST, on all the services or goods received by it from unregistered suppliers. The society will be entitled to claim set off of the GST paid on such supplies, against its GST liability with respect to maintenance charges.

It may also happen that the society may be paying GST at different rates, for the goods and services purchased by it and availing of the input credit on it.

Hence, the society may recover lower maintenance charges, to pass on the benefits of these input credits. The exact benefit of lower maintenance charges, will depend on the input credit available, as well as its liability under the reverse charge mechanism. With the necessity of having to file monthly returns under the GST regime, the overall costs may go up for the society. Due to the higher rate under the GST, as well as the reverse charge mechanism and increased compliance costs, the monthly outgo of flat owners could increase.

AVON VISTA BALEWADI PUNE 2BHK 3BHK 4BHK

Balewadi, Pune

PYRAMID ATLANTE WAKAD PUNE 2BHK 3BHK

Wakad, Pune

Kalash Montage Baner Pashan Link Road 3 and 4 BHK Price Location Floor Plan Review

Baner Pashan Link Road, Pune

Majestique Prime West Mahalunge Balewadi Pune 2BHK 3BHK

Mahalunge, Pune

M RAMANUJAN BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

Rama Metro Life Bizz Bay Tathawade Wakad Pune Commercial Project

Tathawade,Pune

B5 Tech Park JST Jayka Synergy Tower Baner Pune Commercial Project

Baner,Pune

VJ IndiWork Baner Central Baner Pune Commercial Project

Baner,Pune

Pyramid Axis Commercial Baner Pune Office Spaces For Sale And Lease Commercial Project

Baner,Pune

Laxmi Avenue Commercial Wakad Pune

Wakad,Pune

GIT Gaurav Icon Tower Wakad Pune Commercial Office Space Showroom Price Location Floor Plan Review

Wakad,Pune

ATC Amar Tech Center Viman Nagar Pune Commercial Office Space For Lease

Viman Nagar,Pune

Haute Capital by Bhansali Baner Pune Commercial Project

Balewadi,Pune

SBC Sadanand Business Center Baner Pune Commercial Office Space Lease Location

Baner,Pune