Teerth Exchange Baner Pune Commercial Project Office Space Showroom Lease Floor Plan Review

Baner,Pune

There’s always debate when it comes to pinning down one best investment strategy. Our view is pretty simple, real estate investing is the best investment strategy. Now is one of the best times in history for real estate investing – here are 8 reasons why.

If you’re interested in an income producing investment, real estate in your best investment strategy. One of the greatest perks of real estate investing is its ability to generate positive cash flow and steady passive income. Also, there are multiple ways other than rental properties in which you can make a profit in real estate. These include buying property at a low price, selling it at a higher price, the ability to build equity, among many others.

Another reason why real estate is the best investment strategy is the fact that you can invest for cash flow in the short run, appreciation in the long run, or both. Of course, your decision should depend on your investment plans, but here is why you may consider investing for appreciation.

Real estate property prices are increasing annually. The change in demographics in the India, supply shortages, and scarcity of land are all reasons why prices are on the rise. Today’s properties are guaranteed to go up in value in the next 10–20 years. So if you are investing with the purpose of realizing your gains in the long term, real estate investing is the best investment strategy for you. At the same time, keep in mind that you may need to also invest for cash flow, so do not rely on appreciation as your sole source of future income.

This is one of the top reasons why real estate is the best investment strategy. Property prices and rents tend to go hand in hand with inflation forces. So when inflation occurs, it is justified for you to increase the rent as a result. Other investments such as stocks don’t particularly ‘enjoy’ this perk that comes with real estate investing.

Real estate investing comes with numerous tax benefits. You can get tax deductions on mortgage interest, cash flow from investment properties, operating expenses and costs, property taxes, insurance, and depreciation (even if the property gains value). Make sure to record everything from the costs of maintenance, to utilities, rental repairs, and insurance, on your rental property to help reduce your taxes.

When you invest in real estate, you essentially become your own boss. You become the maker of the decisions whether it’s deciding on your tenants, how much to charge for rent, or when to buy and sell. Taking part of the decision making process is also a reason why real estate is a less risky investment. Because of this, it’s much easier to control and regulate. Of course, there are external factors that affect real estate, but at the end of the day, you call the shots, and you become liable for the choices you make. So if you’re the type of person who likes to be in charge, and who likes to have control over your business, real estate may be the best investment strategy for you.

If you buy an investment property using a bank loan, you will enjoy a high degree of leverage. Let’s assume your property costs 200,000, and you put in a down payment of 25%. That means that you’ve paid 50,000 in cash, and asked the bank to finance the rest. What’s great about real estate investing is that the minute you own the property, you are free to rent, sell, flip, etc. So if you rent out the property, the income you receive will help you pay the rest of your mortgage. If you sell the property at 250,000 let’s say, you’ll be making 100% in profits.

You can also invest in multiple properties at a time, enjoy the leverage, and increase your overall net income and net wealth!

Real estate is one of the best retirement plans out there whether you’re looking for an early or regular retirement plan. Investing in a rental property will help you generate regular, steady, passive income for your golden years. If planned and conducted successfully, a real estate investment plan can secure your entire retirement. Of course, you’ll need to be systematic and well knowledgeable in order to make the best investment. So make sure to browse through Purple Realtors (www.purplerealtors.com ) in your search for investment properties.

Investing in real estate is easier when you know the numbers and what to expect. Use investment analytical tools to view information on cash on cash return, cap and occupancy rates, rental income, and much more. An interactive investment property calculator will help you make predictions on the best investment strategy to use.

To Sum Up…

As you can see, real estate investing comes with numerous advantages and perks. But you must know that it’s not always easy and simple. You’re going to have to research, plan, ask around, and be well knowledgeable in the real estate world. But be sure of one thing, real estate is definitely the best investment strategy!

Sukhwani Celaeno Pimple Saudagar Pune 3BHK 4BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

Godrej Evergreen Square HInjewadi Pune 2 BHK 3 BHK

Hinjewadi, Pune

Ganga Legend County Bavdhan Pune

Bavdhan, Pune

Teerth Exchange Baner Pune Commercial Project Office Space Showroom Lease Floor Plan Review

Baner,Pune

Achalare Business Capital Baner Pune Commercial Project

Baner,Pune

One Place F C Road Pune by Mittal Brothers Commercial Project Shop Showroom Office Space For Sale n Lease Price Location Floor Plan

F C Road,Pune

Greystone by Tremont Baner Pune Commercial Office Spaces

Baner,Pune

Poonawalla Towers by Amar Builders Bund Garden Pune Commercial Project

Bund Garden Road,Pune

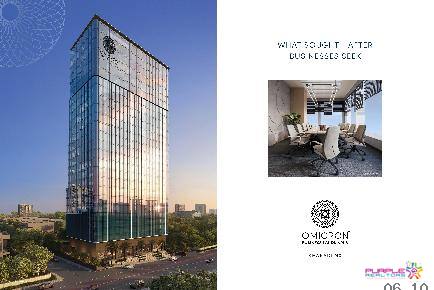

Omicron Business Landmarks Kharadi Nx Pune Commercial Project

Kharadi,Pune

Tej One 1 by Tejraj Baner Pune Pancard Club Road Commercial Project

Baner,Pune

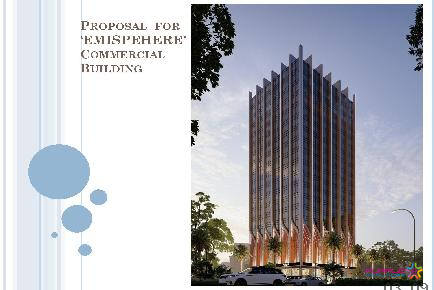

Emispehere Balewadi Pune Commercial Project

Balewadi,Pune

Wakad Business Bay WBB Wakad Pune Commercial Project

Wakad,Pune

Nandan PROBIZ Balewadi Pune Commercial Project

Balewadi,Pune