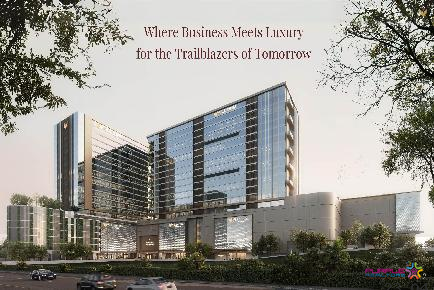

Astra Heights Balewadi Pune Commercial Project For Lease

Balewadi,Pune

Pune

Is real estate an ideal investment asset class when compared to gold, equities, MFs, etc.? We tell you why, despite its erratic performance, it is still a prized asset.

Capital appreciation

Dilkhush Shah, an interior decorator had only Rs 25 lakh to invest. She was advised to opt for mutual funds and gold rather than real estate. However, her research made her realise that real estate stands as an ideal asset class beyond the emotional urge to just own a home. The statistics clearly indicated how no other asset class had given the CAGR (Compounded Annual Growth Rate) as high as property, despite the short-term drop in sentiments.

Leverage

"I chose to invest in property since it is a time-tested investment globally. Yes, with such a small amount, I could only afford a property at Palghar (Mumbai). Keeping the area’s development in mind, I feel this is the best investment bet," says Shah.

High control

The statistics of the ROI, over a long period of investment, have always been in favour of real estate. In the cyclic ups and downs, other asset classes like gold or equity may look more attractive, yet cannot match property.

"I had invested in some stocks that fell from Rs 300 to Rs 45. Since the said company is on a downslide, there is absolutely no hope of recovering my losses. With property, there can be cyclical ups and downs but if you are determined to stay invested, you will not only recover, but also make gains in the process," says Anupam Agarwal, a homebuyer who has also invested in a commercial shop.

Returns

If gold has given returns of 12 percent, residential apartments have given returns of 16 percent and commercial shops have given even higher returns.

Inflation hedging

Real estate is the best bet against an inflation hedge, as it is the only asset that loses little value in periods of rising prices.

Tax savings

In investments like mutual funds or insurance, only a limited amount of investment is covered for tax-saving purposes. Also, in other investment instruments like gold, there are no tax-saving benefits as such

Financial freedom

An investment in property also ensures financial freedom for Indians. Now, with REITs becoming a reality, real estate scores over other asset classes and provides an investor financial freedom

Portfolio diversification

Despite markets being at a two-year high, only a few stocks are at similar highs - most of them are still languishing. In contrast, the momentum in real estate may have slowed down, yet there has been a constant appreciation in the range of 5-20 percent.

Lodha Magnus 3 BHK 4 BHK Flats In Hinjewadi Pune

Hinjewadi, Pune

VJ Palladio LaViento Baner Mahalunge Pune 3BHK

Mahalunge, Pune

Twilight by Majestique Balewadi Pune 3 BHK 4 BHK Light

Balewadi, Pune

ANP Corp Universe Balewadi Pune Luxury 3BHK 4BHK Floor Plan

Balewadi, Pune

Basil Maximus Punawale Pune Residential Project

Punawale, Pune

Astra Heights Balewadi Pune Commercial Project For Lease

Balewadi,Pune

Amar Summit Shivaji Nagar Pune Commercial Office Spaces Price Location Floor Plan

Shivajinagar,Pune

Phoenix Millenium Towers Wakad Pune Commercial Office Space

Wakad,Pune

VJ IndiWork Baner Central Baner Pune Commercial Project

Baner,Pune

Pride Gateway Baner Pune Commercial Project

Baner,Pune

Supreme HQ Headquarters Baner Office Space showroom

Baner,Pune

Rama Metro Life Bizz Bay Tathawade Wakad Pune Commercial Project

Tathawade,Pune

Teerth Exchange Baner Pune Commercial Project Office Space Showroom Lease Floor Plan Review

Baner,Pune

Nandan PROBIZ Balewadi Pune Commercial Project

Balewadi,Pune

M Triumph by Malpani Shivajinagar Pune Showroom Office Space

Shivajinagar,Pune