Jhamtani SpaceBiz Baner Pune Commercial Project Office Space

Baner,Pune

Every Individual dreams of owning his or her own property one day. Most of the times this dream is achieved with financial support from financial institutions like banks in form of loans. But after living in the house for few years it would age and there might come a time when the property would need extensive maintenance and repairs. This would lead to unnecessary tensions financially as it requires extra upfront money for which a home owner might need a loan. In such cases home improvement loan tax benefits play a major role as it makes it easy for a home owner to renovate and repair his or her home.

To avail home improvement loan tax benefits the sum to be paid is provided by the home loan firms. But like a home loan this home improvement loan also comes with an added advantage which is nothing but the reduction of taxes which in the long run is a huge saving. There are several options available in the current market and after consulting different financial firms one can make a wise decision to choose the best of loans available. These home improvement loan tax benefits can be availed by an existing owner or for a new buyer and tax deductions remain eligible in both the cases.

Opt for the right loan

To obtain the home improvement loan you have to submit the details on the repairs along with the documents to the concerned financial institution or bank which offers you the loan. They go through the details and if it matches their rules then a reasonable sum of money would be catered as loan. After they evaluate your loan the official from the firm will do a background check by making a visit to the site and do estimation on the price required by the applicant. If you are an existing client then it is easy to get your loan sanctioned with the diligence that is executed previously.

Advantages of Tax

As per “section 24 (b) of the income tax act 1961” the rate of interest on home loans paid is suitable for reduction to an approximate amount of 30,000 per year. This can be claimed by the owner who has paid loans on a regular basis. Besides, it is best to remember that the overall 1.25 -1.50 lakhs tax benefit can be availed by individuals who fall under this category. Further, this has to be filed along with other taxations while paying your annual income tax.

To sum up, when you own a property and it needs repairs, it is good to go for home improvement loans rather than opting for a personal loan. Not only can you claim tax benefits, but the interest rates are also lower compared to a personal loan. There are several home improvement loan options which are open in the market which a home owner can consider. Compare the current and past market trends to get a clear picture.

So, do little groundwork on home improvement loans, make a list of financial firms or banks which give loans on at low interest rates and choose the best out of it. With these benefits grab your desired home improvement loans for a peaceful and plush living.

Jhamtani SpaceBiz Baner Pune Commercial Project Office Space

Baner,Pune

ONE PLACE BANER PUNE COMMERCIAL OFFICE SPACE AND SHOWROOM

Baner,Pune

ATP Amar Tech Park Balewadi Pune Commercial IT Park

Balewadi,Pune

NAIKNAVARE SEVEN 7 BUSINESS SQUARE SHIVAJINAGAR PUNE SHOWROOM OFFICE SPACE

Shivajinagar,Pune

One Place F C Road Pune by Mittal Brothers Commercial Project Shop Showroom Office Space For Sale n Lease Price Location Floor Plan

F C Road,Pune

Platinum 9 World Tower Wakad Pune Commercial Project

Wakad,Pune

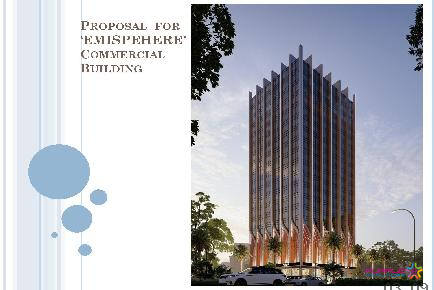

Emispehere Balewadi Pune Commercial Project

Balewadi,Pune

Pride Gateway Baner Pune Commercial Project

Baner,Pune

Panchshil Eleven 11 West Baner Commercial Retail Office Space Showroom Spaces For Lease and Sale

Baner,Pune

Omicron Business Landmarks Baner Pune Commercial Project

Baner,Pune