Nyati Emporius Baner Office Space Showroom

Baner,Pune

Pune

If you are planning to buy a house today, six month after the real estate act came into force, do so after some careful market survey. Do not throw precaution to the winds just because RERA is in force.

The Real Estate (Regulation & Development) Act 2016 was implemented by the Modi government, which established a Real Estate Regulatory Authority (RERA) in each state and Union territory of the country, designed to protect the interest of various stakeholders, particularly homebuyers, in the real estate sector.

An effort is being made through this to streamline the processes and bring much-needed transparency into the sector, which has slowly but surely started increasing the confidence and interest of homebuyers in the realty space.

"If you are planning to buy a house now, six month after the real estate act came into force, you must take some precautions and ensure that the developer has all the required approvals in place and the project is registered under RERA," says Amit Chawla, Associate Director (Valuation and Advisory Services) at Colliers International India.

Keep the following things in mind:

1. Technical aspect: First, check if the project is registered with RERA – it should have a registration number prominently displayed in its advertisements. You should visit the RERA site to find out whether the project is registered with RERA or not. If a project is registered with RERA, you may be assured that it has all the approvals specified in RERA. "Before planning to buy a property, a buyer should check whether the project is registered with RERA; it is imperative for all developers to register themselves, as well as their projects, with RERA. If the project has no registration, better avoid it.

2. Developer's background and financial stability: Only checking the RERA registry is not enough; you should also find out whether the developer concerned has the capability to deliver the project on time. Prefer projects offered by reputed builders who have the capacity to adhere to RERA norms and have the expertise to deliver quality projects.

3. Super built-up and carpet area: Earlier, houses were usually sold based on built-up and super built-up areas, and not by carpet area. "After RERA came into force, developers must specify the carpet area of the proposed project and apartment, and not the super built-up area. This will help a buyer compare and choose a project which offers better efficiency and utility, and make a sound purchase.

4. Know the total cost of the property: Just knowing the basic price of a property is not enough, as there are many additional costs involved. "Especially, if you go through brokers or channel partners, they may only mention the basic cost and ignore other expenses like parking, clubhouse, preferential location charges, etc. Remember to ask for the total cost before booking your house.

5. Possession timeline: Check on the RERA website for the completion and possession timelines the developer has committed; many developers have pushed back the possession date for their projects under construction, while registering them under RERA.

6. Always buy a house through a bank loan: Banks carry out exhaustive checks on any project, and its developer, before giving out home loans on that project. So, even if you have ready money, always buy a property through a ban loan, even if it is only a part of the total cost of the property.

Atmos at Life Republic by Kolte Patil Marunji HInjewadi Pune

Hinjewadi, Pune

K Pune Bavdhan Residential Project

Bavdhan, Pune

Nyati Emporius Baner Office Space Showroom

Baner,Pune

Vertica Balewadi Pune Commercial Project

Balewadi,Pune

ABP AMAR BUILDERS AMAR BUSINESS PARK BANER PUNE OFFICE SPACE FOR LEASE

Baner,Pune

The Anthem by Banyan Tree Realty Anand Park Aundh Pune Commercial Project

Aundh,Pune

West View by Panchshil Koregaon Park Pune Commercial Project WestView

Koregaon Park,Pune

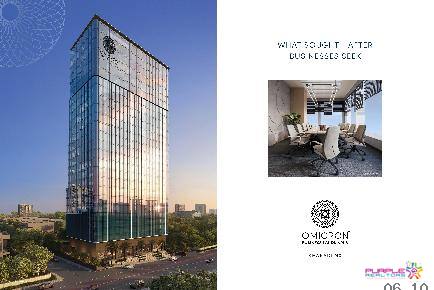

Omicron Business Landmarks Kharadi Nx Pune Commercial Project

Kharadi,Pune

Infinity IT Park by Raheja Aditya Shagun Baner Pune Commercial Office Space for Lease

Baner,Pune

AP4 Tech Park by Amar Builders Wagholi Kharadi Pune IT Park

Kharadi,Pune

ONE PLACE BANER PUNE COMMERCIAL OFFICE SPACE AND SHOWROOM

Baner,Pune

ATC Amar Tech Center Viman Nagar Pune Commercial Office Space For Lease

Viman Nagar,Pune