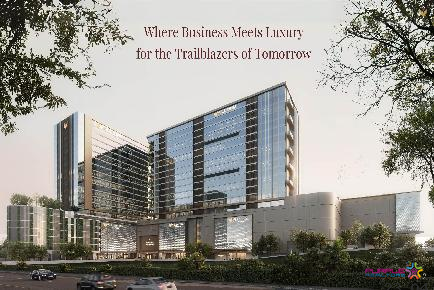

M AGILE BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

Are you planning to transfer your home loan from one bank to another? If yes, we guide you through the process. Read on…

Lately, we have noticed that a significantly higher number of people are transferring their home loan from one bank to another. But what could be the reason behind this move?

Well, it is believed that usually a person undertakes such a task, if he needs to pay off the home loan over a long period of time (15-30 years) and the rate of interest is very high.

What is home loan transfer?

It is a process through which a borrower can transfer his loan from an existing bank to another. It is also called refinancing. For example, if you have borrowed Rs 20 lakh from bank A and have paid some installments and later on you find that bank B is giving you a lower interest rate, then you can shift your outstanding loan amount to bank B. Processing fee is charged on this process, which varies from bank to bank and some documentation has to be done to complete the transfer.

How much can you save?

Transferring of home loan may sound easy, but it is a tricky process and without knowing all the nitty-gritty, you may end up paying more. Let's us take an example. Nikhil Sharma borrowed a home loan of Rs 20 lakh for 20 years at an interest of 9.2 percent. He was paying a monthly EMI of Rs 18,253 to bank A. He continued to pay the same amount for two years and then decided to transfer his outstanding loan amount to bank B at an interest rate of 8.9 percent. If his remaining loan amount is Rs 18 lakh and tenure 18 years, then his monthly EMI will come down to 16,744. You can clearly notice the difference in EMIs.

Apart from this, you also need to check the processing fee and other charges of the new lender where you are planning to transfer your loan. This assessment will help you know how much you can save when you transfer your loan from one bank to another.

"One should put an emphasis on the interest rate at the time of transfer. If he is getting a lower interest rate, then he must transfer his home loan after assessing the cost and savings in the long-term.

"One must keep in mind that the bank has no issues with regard to loan foreclosure. There should not be any cheque-bounce case, no overdue of payments as all these matters are taken into consideration by the new lender."

What is processing fee?

It's a fee payable to the new lender on the home loan account. It usually varies from bank to bank, but you can negotiate with the bank in case you feel it is higher than the market trends. The transaction cost includes the processing fees, documentation charges and stamp duty.

Some banks treat the home loan transfer application similar to a new home loan application. You need to do the math to check the processing fee and other hidden charges and then see how much you’ll be able to save if you go for refinancing. Processing fees on transfer of home loans range from 0.5 percent to one percent of the loan amount. "Some banks do not charge processing fee from those customers who hold a salary account,".

How much time does a transfer take?

Banks take around 10-15 days to transfer your home loan. "A customer can transfer the loan when he has already paid six months’ EMIs. Approval on the property is given by both, the existing and the new lender. A person’s job profile and income are good parameters to judge a person’s repaying capacity," explains Singh. You must be extra cautious while going through this process and do your research. This may be a tedious process, but it’s better to be safe than sorry.

Documents required:

1. A list of property documents held by the existing lender on their letterhead;

2. Latest outstanding balance from your existing financial institution on their letterhead;

3. Photocopy of the property documents (including Own Contribution Proof);

4. KYC documents;

5. Proof of Income:

i. Last three month's salary slips;

ii. Last six month's bank statements, showing salary credits;

iii. Latest Form-16 and IT returns;

6. Others as per the credit requirements.

How to choose a bank?

It is a good idea to transfer your home loan to a bank offering you a lower interest rate. To find out about banks and their corresponding rates, you can research on your preferred banks. Check the processing fee, documents and other hidden charges of the new lender. Compare banks and then choose the one that suits you and offers the best interest rate - both floating and fixed.

"These days, many banks call customers and request them to transfer their home loans by offering them discounts and lucrative offers. Some banks do not even charge a processing fee. One must choose a bank after going through all the details of interest rates, hidden charges and penalties in case of early payment of loan. Many government banks offer lower interest rates and those with clean payment records should not face any problems,

ABIL Castel Royale Bhosale Nagar Pune 4 BHK 5 BHK 6 BHK

Bhosale Nagar, Pune

The Luxe Towers S B Road Pune Exclusive 4 BHK Price Location Floor Plan

Senapati Bapat Road, Pune

PYRAMID ATLANTE WAKAD PUNE 2BHK 3BHK

Wakad, Pune

VTP Cielo Bavdhan Pune 2 BHK 3 BHK 4 BHK

Bavdhan, Pune

M AGILE BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

West View by Panchshil Koregaon Park Pune Commercial Project WestView

Koregaon Park,Pune

Mont Vert Montclaire Baner Pune Commercial Projects Office Spaces Available For Sale and Lease

Baner,Pune

La Commercia Baner Pune Commercial Shop Showroom Office Space For Sale Lease

Baner,Pune

Phoenix Millenium Towers Wakad Pune Commercial Office Space

Wakad,Pune

Pyramid Axis Commercial Baner Pune Office Spaces For Sale And Lease Commercial Project

Baner,Pune

YBZ Yashada Business Zone Baner Pune Commercial Project

Baner,Pune

M Connect by Malpani Bavdhan Pune Commercial Office Spaces For Lease

Bavdhan,Pune

Kakkad One World Baner Balewadi Pune Commercial Project

Balewadi,Pune

Infinity IT Park by Raheja Aditya Shagun Baner Pune Commercial Office Space for Lease

Baner,Pune