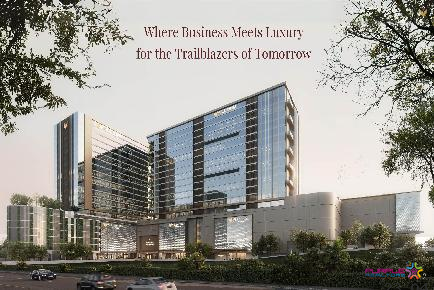

45 West by Kolte Patil Baner Pune Commercial Project

Baner,Pune

Pune

People deliberating about buying their dream home might have to wait a little longer before the impact of the proposed goods and service tax (GST) regime becomes clear on their prospective purchase value.

Experts and real estate representative bodies don't yet have a singular view on the impact of the new indirect tax regime. GST has been fixed at 12% for under-construction and new projects. A lot of raw materials like cement and steel have been fixed at a 28% taxation rate.

The Confederation of Real Estate Development Association of India (Credai) said due to multiple layers of taxation like GST on land, raw materials and stamp duty, the overall project cost might go up. It has appealed that state governments abolish stamp duty.

However, the state governments are reluctant as it is a lucrative source of revenue.

"For the real estate sector, 12% GST rate is only a fraction of its tax burden. The sector is exceptional because the GST regime does not eliminate multiple-taxation here. Stamp duty will also continue to remain in force even after implementation of GST. The additional burden on the sector on account of the stamp duty averages 5%-8%," Credai said in a statement.

A section of experts, however, feel that the input tax credit that developers get for cement and other items may be passed onto the buyer by lowering the cost of the housing units being sold.

"With the input tax credit on construction materials available in full, the effective GST rate on the sector should be less than 12%," Alok Jha, AVP-Research, JLL India, said.

National Real Estate Development Council president, Praveen Jain said in the affordable and budget housing segments, GST rate could be higher by 1.5% to 5% when compared to the prevailing rates.

Austin One Pimple Saudagar Pune 3 and 4 BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

Livience Aleenta Baner Pashan Link Road Pune 3 BHK 4 BHK Price Location Floor Plan Review

Baner Pashan Link Road, Pune

45 West by Kolte Patil Baner Pune Commercial Project

Baner,Pune

Mont Vert Montclaire Baner Pune Commercial Projects Office Spaces Available For Sale and Lease

Baner,Pune

Nandan PROBIZ Balewadi Pune Commercial Project

Balewadi,Pune

Omicron Business Landmarks Baner Pune Commercial Project

Baner,Pune

The Anthem by Banyan Tree Realty Anand Park Aundh Pune Commercial Project

Aundh,Pune

YBZ Yashada Business Zone Baner Pune Commercial Project

Baner,Pune

M Triumph by Malpani Shivajinagar Pune Showroom Office Space

Shivajinagar,Pune

Phoenix Millenium Towers Wakad Pune Commercial Office Space

Wakad,Pune

Panchshil Eleven 11 West Baner Commercial Retail Office Space Showroom Spaces For Lease and Sale

Baner,Pune

45 Baner Street Baner Pune Commercial Project

Baner,Pune