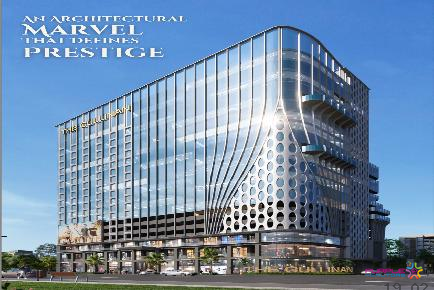

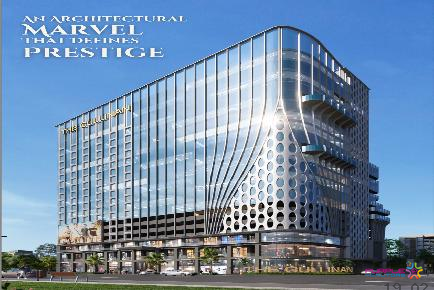

The Cullinan by Garve Pimple Nilakh Pune Commercial Project Floor Plan Review

Pimple Nilakh,Pune

Real estate is mostly conceded on to family members or relatives either as a gift or under a will. A gift of immovable property, in legal parlance, is covered under Transfer of Property (TP) Act, 1883, Income Tax Act, Gift Act and Finance Act and in some case also has income tax implications.

"While gifting immovable property, which is more than 50,000 in terms of stamp duty, the transfer must be done through a registered instrument provided under the Registration Act by the donor and should be attested by at least two witnesses. The title of the ownership cannot be passed without a registered deed gift and donee cannot become a lawful owner."

The law also states that the donee has to pay taxes as defined in the Act, although, as per Gift Tax Act there are no gift tax implications on the real estate (property) transfer if the person is a relative as per the defined list. However, if donor is not related to the donee, then donee shall have to pay the applicable taxes.

Presidential Tower Pimple Saudagar Pune 3 BHK 4 BHK Price Location Floor Plan Review

Pimple Saudager, Pune

Mahindra Citadel Bastion PCMC Pune 2 3 4 BHK Price Locfation Floor Plan Review

Pimpri Chinchwad PCMC, Pune

Godrej Evergreen Square HInjewadi Pune 1 BHK 2 BHK 3 BHK

Hinjewadi, Pune

Nandan Festiva Aundh Pune 4 and 5 BHK Floor Plan

Aundh, Pune

The Cullinan by Garve Pimple Nilakh Pune Commercial Project Floor Plan Review

Pimple Nilakh,Pune

Amar Summit Shivaji Nagar Pune Commercial Office Spaces Price Location Floor Plan

Shivajinagar,Pune

M Connect by Malpani Bavdhan Pune Commercial Office Spaces For Lease

Bavdhan,Pune

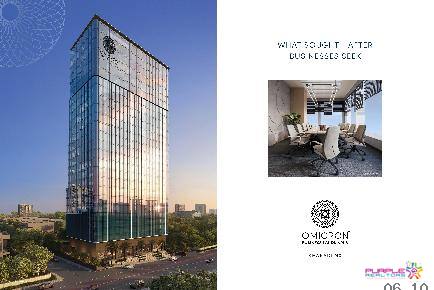

Omicron Business Landmarks Kharadi Nx Pune Commercial Project

Kharadi,Pune

The Anthem by Banyan Tree Realty Anand Park Aundh Pune Commercial Project

Aundh,Pune

Nandan PROBIZ Balewadi Pune Commercial Project

Balewadi,Pune

AMAR AD One Baner Pune Commercial Project Office space Price Location Floor Plan Review

Baner,Pune

Panchshil Eleven 11 West Baner Commercial Retail Office Space Showroom Spaces For Lease and Sale

Baner,Pune

ABIL Boulevard Koregaon Park KP Pune Commercial Project For Lease

Koregaon Park,Pune

M Triumph by Malpani Shivajinagar Pune Showroom Office Space

Shivajinagar,Pune