WYNG by Kundan Spaces Camp Pune Commercial Office Space Price Location Floor Plan Review

Pune,Pune

The Cabinet cleared 100% FDI under automatic route for real estate broking services on the grounds that real-estate broking service does not amount to real estate business and is, therefore, eligible for 100% FDI.

In a post-RERA (Real Estate (Regulation and Development) Act) the fact that all brokers need to register themselves with the RERA authorities has already led to some regulation and structure in the industry.

The brokerage industry has been scattered and the new policy initiatives are good to structure the business. He sees the advent of a lot of organized brokerages from the US and Europe entering India. With an acute shortage of industry-ready professionals, he expects a significant growth of the broker training and education industry and predicts that this may soon become a profession of choice for a lot of professionals. The ground rules established by RERA, more listed developers, building structures of quality and price in defined timelines will lead to listed brokers being able to sell in a regulated fashion. Opening services for FDI through the automatic route is one way for the government to create more jobs.

The most important change would be a clarity in financials. He believes that many more brokerage brands will emerge, some with external affiliations and others through domestic and global consolidation. He believes that the first change that is expected to come into the Indian market is a bump-up in training of brokers.

Coming close on the heels of the GST (Goods and Services Tax) the secondary markets have already shown signs of revival, simply because the completed property does not attract GST while under-construction primary property does. Sharma of Re/Max feels this FDI move may further strengthen the secondary markets, though no substantive study in the rise of secondary markets has yet been undertaken.

the move is welcome for real estate brokerage companies, especially for international and organised entities. "Large-scale and long-term leasing in large and medium metros will see a big growth, we think."

Structuring of the real estate brokerage business and its transformation into financially compliant and end-user focused businesses seems to be the thrust of the new law. The consumer, who had taken centre stage in 2017 as far as primary market policy was concerned, is now being addressed in the secondary market business too. The switch may be slow and many more statutory interventions may be required before the 10-20% registered brokers grow to a large majority in the country. But structured finances will result in more training facilities and organised brokerage houses with whom smaller brokers can get aligned and trained.

Lodha One Bund Garden Pune Exclusive 5 BHK Price Location Floor Plan Review

Bund Garden Road, Pune

VTP Earth One 1 Mahalunge Pune Residential Project

Mahalunge, Pune

WYCE Exclucity Bavdhan Pune 2BHK 3BHK 4BHK

Bavdhan, Pune

WYNG by Kundan Spaces Camp Pune Commercial Office Space Price Location Floor Plan Review

Pune,Pune

KWT KOHINOOR WORLD TOWER PIMPRI PUNE COMMERCIAL OFFICE SPACE SHOP SHOWRROM

Pimpri Chinchwad PCMC,Pune

Pebbles Business Bay Wakad Pune Commercial Project

Wakad,Pune

Rama Metro Life Bizz Bay Tathawade Wakad Pune Commercial Project

Tathawade,Pune

45 West by Kolte Patil Baner Pune Commercial Project

Baner,Pune

ABZ AMAR BUSINESS ZONE BANER PUNE

Baner,Pune

Cornerstone Maruti Millennium Tower Baner Pune Commercial Project

Baner,Pune

M AGILE BY MALPANI BANER PUNE COMMERCIAL PROJECT

Baner,Pune

Nandan PROBIZ Balewadi Pune Commercial Project

Balewadi,Pune

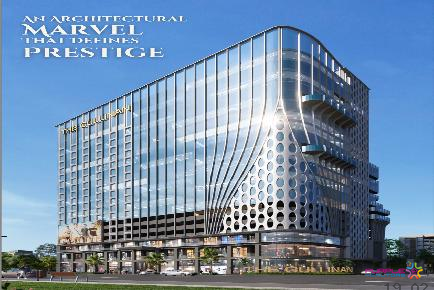

The Cullinan by Garve Pimple Nilakh Pune Commercial Project Floor Plan Review

Pimple Nilakh,Pune