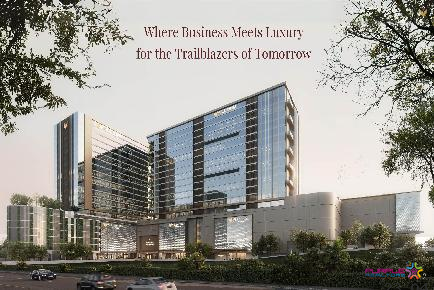

Trump World Centre Mundhwa Pune Commercial Project

Mundhwa,Pune

Pune

The year 2017 has been rather significant for the real estate sector of India due to the implementation of various reforms, which includes RERA, GST and Benami Transactions Act. Hence, 2018 is now been perceived by experts as a year wherein major transactions and activity are bound to take place.

As per the World Investment Report 2016 by the United Nations Conference for Trade and Development (UNCTAD), India ranked fourth for FDI inflows for trade and development. India's FDI inflows have increased to $44 billion in 2015 as compared to $35 billion in 2014, and the growth has been across the board, the report said. Therefore, it is believed that global capital flow into Indian real estate will escalate further due to improvement in regulatory structure and an increase in transparency. Even the Private Equity (PE) inflow into real estate has so far been $32 billion.

Earlier, buyers were not keen on investing in projects due to an indefinite delay in delivery of their homes; however, due to RERA, the realty market has undergone a complete overhaul. With buyers now assured about the delivery date of the dream homes and developers too working towards providing more accountability and ensuring transparency in their working process, the consumer confidence has only increased.

Additionally, the cabinet also recently approved 100 per cent FDI under automatic route in the construction development segment, which includes townships, housing, built-up infrastructure and real estate broking services. It also clarified that real estate broking services do not amount to real estate business and is, therefore, eligible for 100 per cent FDI under automatic route.

These steps taken by the centre is a sign towards making real estate a more organised sector, which will thereby help in raising capital that will in turn ensure that the market grows in a rapid manner.

Besides, the further relaxation in FDI policy will open a gateway for India as a global retail market. It will also attract foreign investors; organised flow of the money and facilitate the entry of some of the international trade practices into the Indian real estate sector. According to a recent study, the Indian retail segment is anticipated to touch $1 trillion by 2020, thus growing at an estimated compounded annual growth rate of 15 per cent.

Also, the government’s ambitious missions such as 'Housing for All By 2022' and construction of 100 Smart Cities will now get a further impetus due to the involvement and interest of foreign investors. Overall, all these steps will take the realty market in the right direction and drive demand from the buyers.

Sukhwani Celaeno Pimple Saudagar Pune 3BHK 4BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

Legacy Kairos Rahatni Pimple Saudagar Pune 2 BHK 3 BHK 4 BHK

Pimple Saudagar, Pune

AVON VISTA BALEWADI PUNE 2BHK 3BHK 4BHK

Balewadi, Pune

Lodha Magnus 3 BHK 4 BHK Flats In Hinjewadi Pune

Hinjewadi, Pune

Amberwood Pimple Saudagar Pune 3BHK 4BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

Trump World Centre Mundhwa Pune Commercial Project

Mundhwa,Pune

Nandan PROBIZ Balewadi Pune Commercial Project

Balewadi,Pune

ATP Amar Tech Park Balewadi Pune Commercial IT Park

Balewadi,Pune

Amar Builders AMTP Amar Madhuban Tech Park Baner Pune IT Park Office Spaces For Lease

Baner,Pune

TOD SURATWALA MARK PLAZZO HINJEWADI PUNE COMMERCIAL PROJECT

Hinjewadi,Pune

ATC Amar Tech Center Viman Nagar Pune Commercial Office Space For Lease

Viman Nagar,Pune

Supreme HQ Headquarters Baner Office Space showroom

Baner,Pune

Phoenix Millenium Towers Wakad Pune Commercial Office Space

Wakad,Pune

AMAR AD One Baner Pune Commercial Project Office space Price Location Floor Plan Review

Baner,Pune

Gera imperium gateway Pimpri PCMC Pune Commercial Project

Pimpri Chinchwad PCMC,Pune