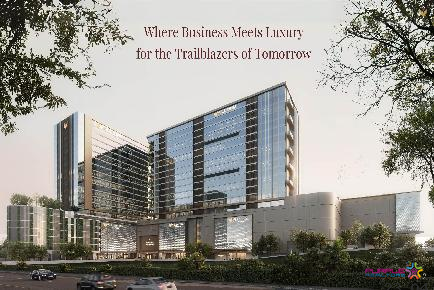

Greystone by Tremont Baner Pune Commercial Office Spaces

Baner,Pune

In India, real estate as an investment has been completely ignored by the young and restless in the last decade or so. There are two reasons to it, first the unscrupulous builders having duped investors and second the stock markets. The real estate prices have been stagnant for the last four to five years due to lack of demand or lack of enthusiasm.

The young and restless had been investing in the stocks/mutual funds given the huge success of the stock markets hitting newer highs every day. They were being guided by their tech-savvy peers of the same age group ready with ready reckoner of how fantastic returns they could generate with SIPs.

Crashing of the global stock markets due to Corona outbreak has made a huge dent in the investments of one and all in the stock markets. Relentless selling by the global fund houses/hedge funds have brought down the NAVs of the mutual funds. With the current route in the Indian market, returns from the mutual funds have become negative. The best fund returns over the last one/ three years is -5.96%/+8.5% and from the worst hit large funds like HDFC Top 100 is -29.2%/-4.2%. Essentially meaning that in best return from a mutual fund house in stocks in the last three years is 0% as of today. Even the debt funds have not been spared with bonds of DHFL being virtually written off and RBI writing off ATi bonds of Yes Bank. In case the stock markets don’t show a V-shaped recovery, the SIPs will simply evaporate.

In order to stem the tide the government will have to consider some drastic steps like inject huge liquidity, lower interest rates and offer tax sops to manufacturing and real estate sector (being the largest employment generator). This is indeed required to save the already fledging economy. This liquidity + lower interest rates are likely to cause inflation in two to three quarters. The investors will start looking at other avenues for investment of surplus cash. With steady prices for the last few years and positive safeguard like RERA in place and lower interest rates, the young might start looking towards real estate. This could help turn the real estate around. Investing in a stable asset which will not fluctuate at the whim and fancy of a hedge fund will be extremely good for the Indian economy.

Legacy The Statement Pimple Saudagar Pune 3 BHK 4 BHK Price Location Floor Plan Review

Pimple Saudager, Pune

WYCE Exclucity Bavdhan Pune 2BHK 3BHK 4BHK

Bavdhan, Pune

VTP Volare Hinjewadi Pune 2 BHK 3 BHK

Hinjewadi, Pune

The Crown at Gera Isle Royale Bavdhan Pune 3BHK 4BHK

Bavdhan, Pune

Ganga Legend County Bavdhan Pune

Bavdhan, Pune

Greystone by Tremont Baner Pune Commercial Office Spaces

Baner,Pune

Phoenix Millenium Towers Wakad Pune Commercial Office Space

Wakad,Pune

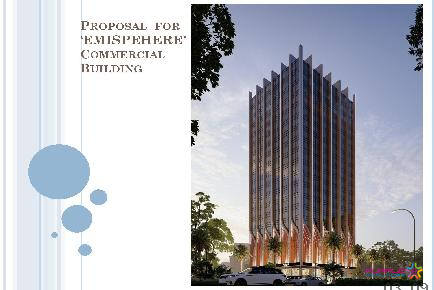

Emispehere Balewadi Pune Commercial Project

Balewadi,Pune

Poonawalla Towers by Amar Builders Bund Garden Pune Commercial Project

Bund Garden Road,Pune

ATP Amar Tech Park Balewadi Pune Commercial IT Park

Balewadi,Pune

Westend Icon Aundh Pune Commercial Office Spaces for Lease

Aundh,Pune

AMAR AD One Baner Pune Commercial Project Office space Price Location Floor Plan Review

Baner,Pune

Prime Pinnacle Wakad Pune Commercial Project

Wakad,Pune

YBZ Yashada Business Zone Baner Pune Commercial Project

Baner,Pune

Platinum 9 World Tower Wakad Pune Commercial Project

Wakad,Pune