AP81 AP83 Amar Pristine Eighty Three Commercial Koregaon Park Mundhwa Pune - Amar Builders Office Spaces For Lease

Koregaon Park,Pune

Is your property portfolio putting your cash flow in a vice? If you’re squeezed for cash because of your investments – and if you’re investing in property, that’s the worst place to be – its probably because you have a negatively geared portfolio.

Sound accurate?

Don’t worry – we’ve got 5 Cash Flow Solutions right here to help free you from financial struggle – and that nasty negative portfolio!

Debt – especially uncontrolled debt – is one of the most damaging things you can do to your cash flow.

Wipe out your debt – especially your bad debt – and you immediately improve your cash flow and expand your lifestyle choices.

Get started now:

Book an appointment – if you haven’t already – with an accountant who is experienced in the tax laws surrounding property investment.

If you’re a earner, claim your tax deductions on a continual basis; either weekly, fortnightly or monthly, and put those monies straight into your offset account where compounding interest can work its magic.

Then, depending upon your personal situation, add more investment properties to increase your wealth.

Begin by looking for areas with strong market drivers:

Using one or more strategies; renovation, second income stream, subdivision, strata and/or a straight-up discount purchase you can put together great positive cash flow deals right out of the gate!

The key is knowing what to look for:

Don’t be afraid to invest in other states. Not only will you speed up the rate at which your portfolio will grow (because you’re not having to wait on the market cycle), you’re greatly expanding your choice of good investment opportunities.

Quickly determine the potential GROSS yield of a property by doing the following:

To calculate the net yield you’ll follow the same formula, however you’ll deduct the actual expenses of the property (not including the interest you pay) before dividing the rent by the purchase price:

Getting a good deal when trading real estate begins when you purchase the property. The idea is to of purchasing the property. Here’s how:

Find markets where the capital growth is consistently strong and then use the equitythe market delivers to fund more deals and to cash flow your lifestyle.

It’s certainly possible to find properties where the equity is already built into the property. In a fast growing marketplace you can tap into that equity in about 12 months time and add to your account where compound interest can get to work growing it even more.

For more Blogs Like this Check - https://purplerealtors.com/blog.php

Click here to like us on Facebook and see more updates like this.

Check Real Estate Updates Here - https://purplerealtors.com

For Residential Projects in Pune Check - https://purplerealtors.com/Residential-Projects

For Commercial Projects in Pune Check - https://purplerealtors.com/Commercial-Projects

If you want more tips about your Property Investment strategy, book a FREE consultation with one of our expert Investment Coaches to discuss your situation and investing goals.

VTP Earth One 1 Mahalunge Pune Residential Project

Mahalunge, Pune

Lodha Magnus 3 BHK 4 BHK Flats In Hinjewadi Pune

Hinjewadi, Pune

ANP Corp Universe Balewadi Pune Luxury 3BHK 4BHK Floor Plan

Balewadi, Pune

Kohinoor Royale Towers Riverside Hinjewadi Pune 2 BHK 3 BHK

Hinjewadi, Pune

AP81 AP83 Amar Pristine Eighty Three Commercial Koregaon Park Mundhwa Pune - Amar Builders Office Spaces For Lease

Koregaon Park,Pune

VJ IndiWork Baner Central Baner Pune Commercial Project

Baner,Pune

Kakkad One World Baner Balewadi Pune Commercial Project

Balewadi,Pune

Amar Builders AMTP Amar Madhuban Tech Park Baner Pune IT Park Office Spaces For Lease

Baner,Pune

Nandan PROBIZ Balewadi Pune Commercial Project

Balewadi,Pune

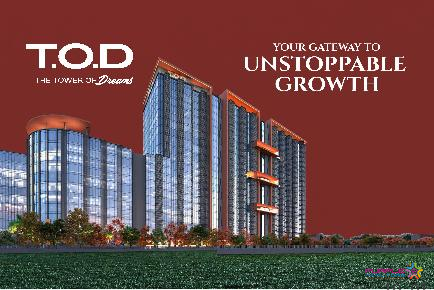

TOD SURATWALA MARK PLAZZO HINJEWADI PUNE COMMERCIAL PROJECT

Hinjewadi,Pune

ATC Amar Tech Center Viman Nagar Pune Commercial Office Space For Lease

Viman Nagar,Pune

Sanas 27 West Balewadi Pune Commercial Project

Balewadi,Pune

Vertica Balewadi Pune Commercial Project

Balewadi,Pune

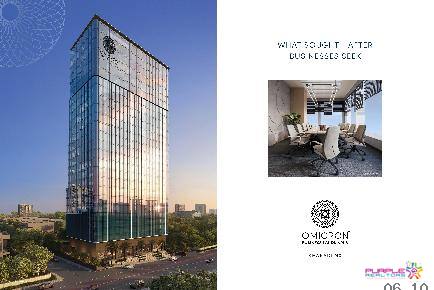

Omicron Business Landmarks Kharadi Nx Pune Commercial Project

Kharadi,Pune