Prime Pinnacle Wakad Pune Commercial Project

Wakad,Pune

The difference between residential and commercial real estate, from an investment point of view is that rental yields are higher in the latter, "In the past two years, residential real estate has seen more appreciation but it has peaked out. Office space continues to give better rental yields. In residential property, (annual) rental yields are around two per cent, while in the case of office space, it is eight to 11 per cent and picking up.

However, capital appreciation is lower in commercial property, as there is a lot of speculative buying in residential property. Office space, on the other hand, is more driven by end-use. While a commercial space might not be as easy to sell as residential space, it is easier to find tenants for office space than for residential.

"Overall, with good quality tenants and lock-in of leases, the office space provides good opportunity for investors. With the interest rate cycle on the decline, one can expect appreciation as capital rates start compressing. Also, with Real Estate Investment Trusts (Reits) expected to hit (the market) soon, liquidity premium can also benefit from the commercial space,''

If you are looking to invest in commercial real estate, here are some things to note.

Income yielding?

It is advisable to invest in a property which is already leased out, since it will assure cash flows. Usually, rental agreements are signed for three to five years in the case of office space and tenants are locked in for that period. And, since the tenant puts money for fit-outs, they are less likely to vacate. So, if you invest, say, Rs 5 crore in an office space, you can expect to get Rs 40-50 lakh as annual rental income.

The type of company that has leased out the property and the kind of business is also important. For instance, if it is a bank or a brand where the office address matters, the chances of it changing offices frequently are fewer. But, a company that depends more on talent or people, has higher chances of moving out.

Buy in a building where there aren't multiple owners and a large part is still with the developer, so that maintenance is not a challenge. And, for companies that will lease out the space, a well-maintained building with good infrastructure is important. "Ideally, the area of the building should not be more than 500,000 sq ft,''. Typically, a single unit of office space could start from 1,000-5,000 sq ft and could go up to 10,000 sq ft.

This is also important, especially if for retail use. For instance, a high street or luxury brand will be willing to lease locations with good frontage, footfall and catchment areas, even if business is not very high. That is why such spaces tend to be more expensive and and as a result of this, rental yields tend to be slightly lower than for office spaces. In the case of retail or high street, annual yields could be five to six per cent. Along with location, also check the amenities being provided, infrastructure (transport, housing) available in that area, occupancy rates in the property and in the neighbourhood, advises Bhatia.

The developer's experience in building and maintaining commercial space, and whether private equity funds or REITS have invested in the property, are also a good indication of the marketability and potential of the project.

Should you leverage?

Since unit sizes in case of commercial real estate are much larger than residential, amounts required for investing are also much higher. Investors must, therefore, be willing to lock in higher amounts of capital.

While there is no tax incentive for investing in commercial real estate, unlike for homes, investors can look at lease rental discounting to increase their investment capability. Investors can take a loan against the potential rental income they are likely to earn from the property. The rent, in this case, is directly paid to the bank. This will enable investors to buy a bigger property.

Investors can also look at a loan against the property. In the case of lease rental discounting or LAP, rates vary from 9 to 11 per cent. "The benefit of taking a loan is the boost in the investment return if the capital appreciation pans out. And, the loan can be structured so that all the payments are met from lease rentals received. However, one must be wary of the risk that if the tenant vacates and a new one cannot be on-boarded immediately, it will severely affect the cash flow structure,''

CHECKLIST

Birla Punya Central Pune 2BHK 3BHK 4BHK

Central Pune, Pune

WYCE Exclucity Bavdhan Pune 2BHK 3BHK 4BHK

Bavdhan, Pune

Legacy The Statement Pimple Saudagar Pune 3 BHK 4 BHK Price Location Floor Plan Review

Pimple Saudager, Pune

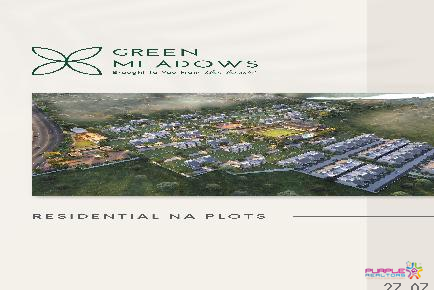

Green Meadows Pachane Nr Hinjewadi Pune Residential NA Plotting

Hinjewadi, Pune

Prime Pinnacle Wakad Pune Commercial Project

Wakad,Pune

AMBROSIA GALAXY BANER PUNE COMMERCIAL PROJECT OFFICE SPACE SHOP SHOWROOM SALE OR LEASE

Baner,Pune

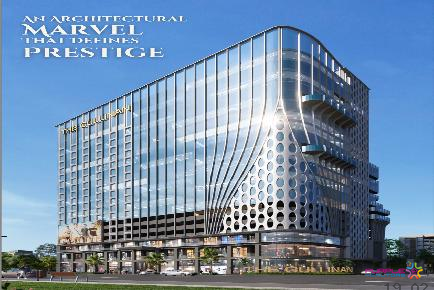

The Cullinan by Garve Pimple Nilakh Pune Commercial Project Floor Plan Review

Pimple Nilakh,Pune

Bellissima Baner Pune Commercial Project For Lease

Baner,Pune

Rama Metro Life Bizz Bay Tathawade Wakad Pune Commercial Project

Tathawade,Pune

Nandan PROBIZ Balewadi Pune Commercial Project

Balewadi,Pune

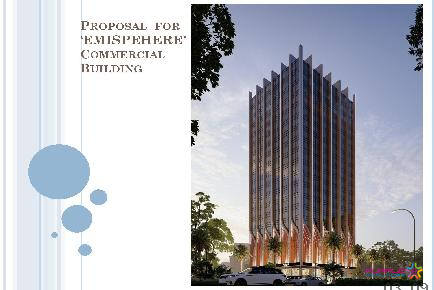

Emispehere Balewadi Pune Commercial Project

Balewadi,Pune

The Anthem by Banyan Tree Realty Anand Park Aundh Pune Commercial Project

Aundh,Pune

West Avenue Aundh Pune Commercial Project Office Space Shop Price Loaction Floor Plan Review

Aundh,Pune

KBT Kohinoor Buisness Tower Mundhwa Pune Commercial Project

Mundhwa,Pune