45 Icon Baner Pune Commercial Office Spaces For Lease

Baner,Pune

Listed below are the challenges and opportunities for growth in the real estate sector in 2018.

Challenges:

Lack of industry status to Real Estate Sector: Delay in according an 'industry status' to the real estate, does not make it easy for the sector to avail of legitimate finances from Banks and other financial institutions. Imagine if clean low cost loans could be obtained from the system, then the cost benefit vis-a-vis high interest loans from outside the system can be passed on to the consumer.

Single window clearance: At present the multiplicity of permissions and approvals that developers are required to secure and the lack of single window clearance, it could take anywhere from 18 months to 36 months before beginning any project. The biggest delays in delivery of houses occur due to delay in approvals of projects and authorities have a major role to play in. An online single window clearance with bare minimum human interface and precise deadlines for approvals will not only bring down the deliveries of the project by at least 3 years but also the cost of the project by at least 15% which can further be passed on to consumers. Going online will also boost transparency and curb any scope for undue gratification in granting permissions, so in case any project needs to be put on hold or denied permission, an online system could clearly mention the reasons for this.

Exemption limit on Interest on Home loan: On the personal taxation front the government should raise tax deduction limit for housing loans up to 5 Lakh from present limit of 2 Lakh per annum, a Rs 2 lakh limit may seem fine for a Rs 20 lakh house, but for Tier 1 cities where housing starts from a minimum Rs 50 lakh house, there present exemption is negligent.

High rates of GST: Home buying is one of the biggest investments of a buyer's life hence government should bring down the GST at 6 % as it will have a positive impact on encouraging purchase of homes, especially by the millions and millions of first time buyers across the nation.

Opportunity:

2018, the year of delivery: Developers are focusing firmly on selling their existing ready inventory and finishing their near completion projects rather than launching new projects. Hence 2018 will be the year of delivery as now sales in the residential market would pick up in few months from now. In past few years, the demand in residential realty market has been dominated by end-user homebuyers and with large number of deliveries lined up in the near future by developers, homebuyers are showing greater interest in ready-to move-in or nearing completion projects.

Growth in low cost housing: 2018 will witness the growth in the low cost housing subject to the availability of land. The surge is expected in this segment especially after the announcement of PMAY.

Return of Luxury housing: With RERA now in place, the confidence of real estate investors are returning back in the sector so High Net worth Individuals and high profile investors will start investing their money into the real estate sector hence leading the demand for the luxury housing.

Reforms of the past year will shape the future of real estate sector in 2018.

2017 has been the transition year for residential real estate developers, who faced several challenges with the aftermath of demonetization, RERA and GST implementation and at the same time they struggled with the unsold inventories as well. Before RERA came in action, there were lots of concerns for homebuyers while investing in a project. Earlier they did not have a point of contact to check the progress of the project invested in. Also, there was no redressal mechanism for either delay in obtaining occupancy certificates/ possession of the project. But now RERA has taken care of all these issues and infused lot of transparency in the system which gives boost to the lot of consumer confidence in the sector as well as to the infrastructure projects in the area. RERA has also brought peace of mind for homebuyers. Till now, potential buyers of under-construction, new launches and pre-launch properties had some big questions in their mind, such as: "how do they know that they have been given correct information, and will the project be delivered on time?" Now as everything is transparent as every registered developer's details are available on RERA's website and they will deliver as per those specifications. That way, a lot of tension associated with the buying process has reduced. The requirement of keeping 70% of the project money into an escrow account gives the assurance of money being available at every stage until the project is completed and handed over to the consumer. RERA ensures that the home buyers are adequately protected and that promoters and developers abide by the rules and regulations. The ACT will also try to protect the interest of consumers ensuring speedy redressal of disputes which will help gain confidence amongst the buyers.

Also, one of the major benefits for real-estate buyers due to RERA act is that if the project completion is delayed, the developer has to pay the same interest as the EMI paid by the buyers. This will enable the government to oblige the developer to stay loyal to their customers. With RERA, there is a mandatory disclosure of project details, including those of the promoter, project, land status and clearances which increases the credibility of developers and protects consumer rights as well. Home buyers confidence is now set to increase on the back of these sentiment-building measures of the government.

GST is also one of the game-changer for Indian industry, including for the real estate sector, since it subsumes more than 16 major taxes and levies into a single consolidated tax. Additionally, the unified tax regime is aimed to stop the unwanted practice of double taxation, which hurt real estate and other sectors, given their cascading effect that inflated prices for end users. With GST enforcing transparent transactions across all domains, this is a blessing in disguise for real estate developers too. While now there is clarity on the taxation front but we believe that GST rate should be brought down as home buying is one of the biggest investments of a consumer’s life hence to encourage more and more buyers Government should consider reducing GST rates.

Even though RERA and GST are set to change the scenario in the industry still a lot of confusion remains in terms of the implementation of these two initiatives as while they are been hailed for bringing transparency in the system but on the other hand their implementation has also been an impediments towards ease of doing business in India. There is no doubt that the long term effect of these initiatives is bound to be positive but at the same time a lot of chinks need to be ironed out in coming months to boost the real estate sector.

Kohinoor Central Park Hinjewadi Pune 2 BHK 3 BHK

Hinjewadi, Pune

Yoo Pristine Akurdi PCMC Pune 2 BHK 3 BHK 4 BHK

Pimpri Chinchwad PCMC, Pune

Pristine The Lords Baner Pashan Link Road Pune 3 BHK 4 BHK Price Location Floor Plan Review

Baner Pashan Link Road, Pune

Vardhman Skytown Rahatni Pimple Saudagar 2 and 3 BHK Price Location Floor Plan Review

Pimple Saudagar, Pune

Birla Punya Central Pune 2BHK 3BHK 4BHK

Central Pune, Pune

45 Icon Baner Pune Commercial Office Spaces For Lease

Baner,Pune

Vertica Balewadi Pune Commercial Project

Balewadi,Pune

Astra Heights Balewadi Pune Commercial Project For Lease

Balewadi,Pune

Trump World Centre Mundhwa Pune Commercial Project

Mundhwa,Pune

ATP Amar Tech Park Balewadi Pune Commercial IT Park

Balewadi,Pune

Wakad Business Bay WBB Wakad Pune Commercial Project

Wakad,Pune

WYNG By Kundan Spaces Camp Pune Commercial Office Space Price Location Floor Plan Review

Pune,Pune

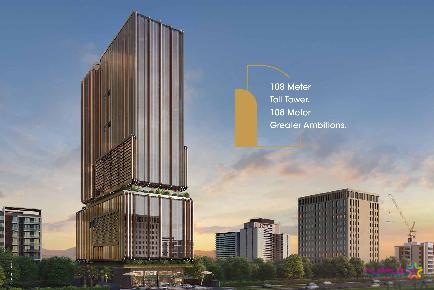

Ceratec 108 Tower Balewadi Pune Commercial Project

Balewadi,Pune

SBC Sadanand Business Center Baner Pune Commercial Office Space Lease Location

Baner,Pune

B5 Tech Park JST Jayka Synergy Tower Baner Pune Commercial Project

Baner,Pune