KBT Kohinoor Buisness Tower Mundhwa Pune Commercial Project

Mundhwa,Pune

The Indian real estate sector was perhaps the most affected in 2017 among all the sectors of the economy but the story is far from over. The implementation of demonetization in November 2016 had the entire economy reeling until the first quarter of 2017 and the one which received the punch right in the stomach was the realty segment.

For a sector which largely depends on contract workers, cash was the biggest casualty because of the demonetization. However, one good fallout of it was that it brought some stability to the land prices thereby making the end products more affordable to the consumers. But by April 2017, when the markets were looking to stabilize, RERA and GST were announced in succession which again caused some inertia due to confusion among buyers and developers alike, with both awaiting the final set of RERA notifications/legislation from their respective state regulatory bodies.

While business cycles have been affected this year due to buyers holding back purchases in anticipation of regulatory changes, and sales are still witnessing a slowdown, we are observing signs of recovery as the triple effects of demonetisation, RERA and GST have begun to shape up the sector with new standards of delivery, accountability and transparency. Post implementation of these reforms, there has been a steady demand for mid-sized apartments, preference towards ready to move-in properties that take the hassle out of any compliance issues and the willingness to pay a premium for long-standing reputed developers.

RERA and GST are propelling global cash flows and boosting endorsements ranking India 4th among Asian countries for FDIs. A fervent financial stratum in the real estate sector will be observed in the coming years as investors and buyers are presented with multiple opportunities – in the residential housing region through the means of incentives for affordable housing and transformation of the office sector through Real Estate Investment Trusts (REITs). With close to 1.73 sq.ft billion of commercial real estate across office, retail and warehouse segments, 2018 is definitely set to experience more REITable listings in India coupled with more investments in REITs due a steady return of 9% to more than 12% annually. The tax incentives, options of diversified investments across the real estate asset class and hence lower risk of investment, more liquidity – all these could potentially attract more REITs in the residential space and residential REITs could soon be a reality.

2018 is expected to be a year of consolidation of products and services in the sector – with the impacts of all policy initiatives taken in the 2016-17 beginning to take effect in the coming year. More joint ventures / joint developments will be the order of the day with financially distressed developers being taken over by larger players and presenting the industry with a fresh line up of competitors. Completion of existing projects will be prioritized over launching new ones, hence, 2018 looks promising for a good supply of houses across major Indian markets. In order to achieve this, developers will be remodelling their business processes to streamline delivery and allied services, without stretching themselves too much in terms of debt or scope of work.

The Government's efforts to boost "affordable housing" by conferring "infrastructure status" to this segment, announcing various tax incentives and increasing the carpet area of houses to include more projects within its ambit, will continue to attract more prominent developers to realign their products to compete in this category. Drawing from the policy, it can be said that builder stands to gain in terms of incentives from the Government and the customer will equally benefit from the interest rate subsidy. Both buyers and sellers will benefit as options increase for the former and inventories are cleared for the latter. Such measures of the Central government have also resulted in the availability of more funding options for developers such as external commercial borrowing (ECB), foreign direct investment (FDI) and debt financing from national financial institutions at highly competitive rates. Although challenges remain in Tier 1 cities, where land costs and availability within established locations is difficult, affordable housing is turning into a promising sector and a possible game changer for the real estate industry. In 2018, it will definitely become an important segment in every developer’s portfolio.

Developers could also be focusing on their niche expertise in the new year, specializing in the various segments of real estate, e.g., plotted developments, residential projects, retail, townships, and commercial spaces; and hence, specialist service providers could be emerging in each of these categories. Market forces will lead to specialists emerging in each individual segment of real estate, hence verticalization of the sector could be setting in with 2-3 players topping each segment.

Today India has approximately 350 co-working space operators running over 800 co-working spaces, thanks to the general drive for entrepreneurship that allows budding entrepreneurs start a business economically through flexible working hours, and varied desk options; and also provides them a platform for networking, collaboration and increased productivity along with ease of scaling. Research predicts that by 2025, 42% of India's population will be living and working in its urban centres. With this growth in the urban population, there will be a far greater demand for shared workspaces in less than a decade. The segment is expected to receive $400 million in investments by 2018 and is set to grow by 40-50% to reach over 1 million sq. ft. of leased 'alternative' workspaces by the end of the next fiscal year.

I am also hopeful of more spends towards digitisation of land/property records in the coming year, which is in tune with the Digital India vision of the PM. This will considerably reduce litigation, free up more lands in cities to make it more affordable and reduce project timelines which will directly translate to lower costs for the end consumer. In addition, taking from the Maharashtra RERA ruling, other state RERA bodies could be widening the RERA laws in their respective states to include other stakeholders like various government approval bodies in a bid to ensure speedy approvals, one of the main reasons for construction delays, to spread accountability and ultimately benefit the end user.

Global Inspira HInjewadi Pune 2 BHK 3 BHK

Hinjewadi, Pune

Yoo Pristine Akurdi PCMC Pune 2 BHK 3 BHK 4 BHK

Pimpri Chinchwad PCMC, Pune

VTP MONARQUE HINJEWADI PUNE 2 BHK 3 BHK

Hinjewadi, Pune

Unique Sky Links Baner Pashan Pune 3 BHK 4 BHK Price Location Floor Plan Review

Baner Pashan Link Road, Pune

KBT Kohinoor Buisness Tower Mundhwa Pune Commercial Project

Mundhwa,Pune

Panchshil Eleven 11 West Baner Commercial Retail Office Space Showroom Spaces For Lease and Sale

Baner,Pune

Baner Central Baner Pune Commercial Project

Baner,Pune

Amar Builder ASTP Amar Sadanand Tech Park Baner Offices Showroom

Baner,Pune

SAI MILLENIUM PUNAWALE PUNE COMMERCIAL PROJECT

Punawale,Pune

SURATWALA MARK PLAZZO HINJEWADI COMMERCIAL OFFICE SPACE SHOP SHOWROOM

Hinjewadi,Pune

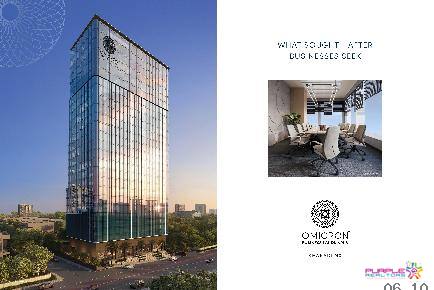

Omicron Business Landmarks Kharadi Nx Pune Commercial Project

Kharadi,Pune

Achalare Business Capital Baner Pune Commercial Project

Baner,Pune

Poonawalla Towers by Amar Builders Bund Garden Pune Commercial Project

Bund Garden Road,Pune

Sanas 27 West Balewadi Pune Commercial Project

Balewadi,Pune