Malpani M Aryabhatta Baner Pune Commercial Project For Lease

Baner,Pune

With a focus on affordable housing, infrastructure, connectivity, MSME, rural development and smart cities, the Union Budget 2018 has met some expectations and some are still in the pipeline believe the National Real Estate Development Council (NAREDCO). The government has taken several key initiatives in the budget such as new airports, fund for metro networks and a dedicated fund for affordable housing which are all clubbed together going to increase growth across Tier 1, 2 and 3 cities.

Some of the expectations such as a single window clearance, lower GST rate, and industry status to the entire real estate sector are still awaiting the government's approval.

Let us find out what has this budget brought for the real estate sector.

Affordable Housing

Affordable Housing gets preferential treatment yet again in the budget. A dedicated Affordable Housing Fund (AHF) will be created in National Housing Bank, funded from priority sector lending shortfall and fully serviced bonds authorised by the Government of India.

As many as 51 lakh houses in rural areas are to be built in 2018-19. In urban areas, the assistance has been sanctioned to construct 37 lakh houses. Experts feel that it will create an impetus for the housing sector and make progress towards housing for everyone by 2022.

"The Finance Minister's announcement of a dedicated affordable housing fund (AHF) in National Housing Bank, funded from priority sector lending short fall and fully service bonds, authorized by Government of India, is a welcome decision. This will help in achieving the vision of Housing for All by 2022,"

Smart Cities

The Smart Cities Mission has got a hike of 2.82 in this budget. It aims at building 100 Smart Cities with state-of-the-art amenities. "I am happy to inform that 99 Cities have been selected with an outlay of Rs 2.04 lakh crore. These Cities have started implementing various projects like Smart Command and Control Centre, Smart Roads, Solar Rooftops, Intelligent Transport Systems, Smart Parks. Projects worth Rs 2,350 crore have been completed and works of Rs 20,852 crore are under progress," Finance Minister Arun Jaitley informed the Parliament.

"Government expenditure on thousands of projects initiated under Smart Cities Mission across India has already created a large marketplace for private sector and is going to further translate into jobs at all level, better and efficient infrastructure and liveable cities for everyone," says NSN Murty, Partner and Leader- Smart Cities, PwC India.

Circle Rates

The Budget proposes that real sale value of immovable property would be taken into consideration while taxing income from capital gains if circle rate value does not exceed 5 % of the consideration. Sellers would not be pay higher capital gains tax if the difference is within 5% circle rates. "This section is wrong and has to be abolished. Ready reckoner rates have increase disproportionately over the time. This section punishes if I sell my flat and NAREDCO wants to do away with it. The second is notional tax on vacant houses which has to be removed as well. You need give concession to have surplus of houses and to increase the demand. You also need to reduce the stamp duty to meet the objectives of housing for all," says Hiranandani in a post budget press event.

Stamp Duty

It was announced in the budget that the government will take reform measures with respect to stamp duty regime on financial securities transactions in consultation with the state governments and make necessary amendments in the Indian Stamp Act. "Entry and exit are very challenging in the real estate sector. You have to pay 12 % GST and when you sell your property you again have to pay Stamp Duty. The government needs to bring down GST rate to 6 % from current 12% and also reduce stamp duty charges to have a surplus houses," added Hiranandani.

Infrastructure

Infrastructure is the growth driver of Indian economy, the Budget 2018 focused entirely on connectivity and integration of the nation with a network of roads, airports, railways, ports and inland waterways. Government’s estimated budgetary and extra budgetary expenditure on infrastructure for 2018-19 is being increased to Rs 5.97 lakh crore.

Key infrastructure projects:

1. National Highways exceeding 9000 kilometers length are expected to be completed during 2017-18.

2. Bharatmala Pariyojana will provide seamless connectivity of interior and backward areas and borders to develop about 35000 kms in Phase-I at an estimated cost of Rs 5,35,000 crore.

3. NHAI will consider organizing its road assets into Special Purpose Vehicles and use innovative monetizing structures like Toll, Operate and Transfer (TOT) and Infrastructure Investment Funds (InvITs).

4. Redevelopment of 600 major railway stations is being taken up. All stations with more than 25000 footfalls will have escalators.

5. All railway stations and trains will be progressively provide Wi-Fi. CCTVs will be provided at all stations and on trains to enhance security of passengers.

6. Mumbai's transport system is being expanded and augmented to add 90 kilometers of double line tracks at a cost of over Rs 11,000 crore. 150 kilometers of additional suburban network is being planned.

7. Bengaluru’s long-pending demand for a full-fledged suburban rail project received financial support. The Budget 2018 allocates Rs 17,000 crore for the Bengaluru metro.

8. An Institute is coming up at Vadodara to train manpower required for high speed rail projects to cater for needs for the Mumbai-Ahmedabad bullet train project.

9. Regional connectivity scheme of UDAN initiated by the Government last year shall connect 56 unserved airports and 31 unserved helipads across the country. Operations have already started at 16 such airports.

10. A proposal to expand airport capacity more than five times to handle a billion trips a year under a new initiative – NABH Nirman announced.

The Budget appears to strike a balance and do not seem to tilt towards any sector in particular. The Government seems to focus more on affordable housing and wants to achieve its objective of providing housing for all by 2022. Announcement to amend the Indian Stamp Act shows that the government is serious to bring down the property prices and have a single tax for home buyers.

VTP Earth One 1 Mahalunge Pune Residential Project

Mahalunge, Pune

The Altius and Ridges 41 by Paranjape Blue Ridge Hinjewadi Pune

Hinjewadi, Pune

Malpani M Aryabhatta Baner Pune Commercial Project For Lease

Baner,Pune

AMBROSIA GALAXY BANER PUNE COMMERCIAL PROJECT OFFICE SPACE SHOP SHOWROOM SALE OR LEASE

Baner,Pune

Kushal Wall Street F C Road Pune Commercial Retail and Office Spaces Price Location Floor Plan

F C Road,Pune

West View by Panchshil Koregaon Park Pune Commercial Project WestView

Koregaon Park,Pune

West Avenue Aundh Pune Commercial Project Office Space Shop Price Loaction Floor Plan Review

Aundh,Pune

Infinity IT Park by Raheja Aditya Shagun Baner Pune Commercial Office Space for Lease

Baner,Pune

45 Baner Street Baner Pune Commercial Project

Baner,Pune

Greystone by Tremont Baner Pune Commercial Office Spaces

Baner,Pune

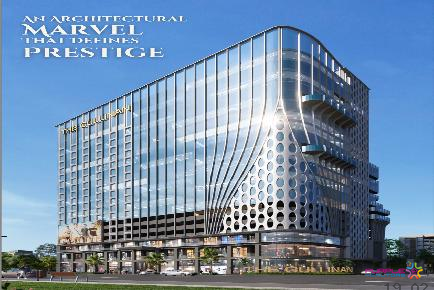

The Cullinan by Garve Pimple Nilakh Pune Commercial Project Floor Plan Review

Pimple Nilakh,Pune

57 Avenue Wakad Pune Commercial Project

Wakad,Pune